How to Activate Venmo Debit Card? Basics Questions and Answers

At this point of time, using a fast payment app is not enough. For hassle-free payment experience your payment app must be user-friendly, safe, & secure. If that's all that matters most to you then the Venmo Debit Card must be your first choice. Yes, you will be glad to know that now you can do more with your favorite payment app- Venmo.

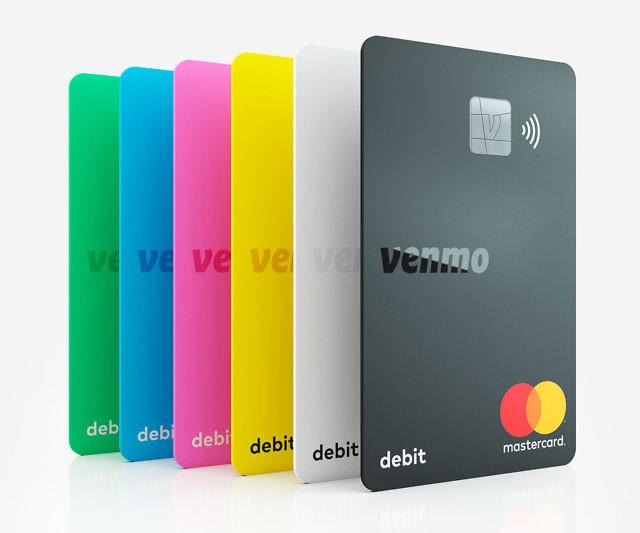

Many of you might be aware of the fact that Venmo offers innovative and top-notched money transfer services. But, what's less known is that Venmo also offers free but effective debit card services. If a Venmo card is a little known thing to you then, this post is for you. Right here in this helping post, I am going to let you know all about the exclusive debit card service of Venmo.

To help you understand all about the Venmo MasterCard, I am going to answer some of the basic questions and answers about Venmo cards. So, as we always do, let's put first thing first.

What is a Venmo Debit Card?

As the name implies, a Venmo card is nothing but just a typical debit card service. It works in the same as any typical bank's debit card does. Likewise any other debit card, users can use it to make payment at any store, shop, gas station, and market where Mastercard is acceptable as a payment method. Plus, users also can withdraw money at a large number of ATMs with ease of mind.

Moreover, you will be glad to know that any Venmo user can order, set up, and use a Venmo card. It is free to order and easy to use, and safe to make instant payment wherever a mastercard is acceptable as a payment method. As we are talking about Venmo Mastercard, it is worth noting that this card comes with some limitations as well. From limitations, I mean Venmo account holders are supposed to use Venmo cards in a limited way. So, let's get over it in detail in the next section.

Also Read: How to activate Venmo direct deposit?

What is the Venmo Debit Card limit?

Be informed that any user who is unverified can spend up to $299.99 through Venmo debit card. On the other hand, who are verified Venmo users, they can spend $ 4,999.99 in a week. Also, be informed that Venmo Mastercard could not be linked to the bank accounts. It means, Venmo users can't withdraw money from a linked bank account at any ATM directly. To do so, what you have to do is first transfer money from your linked bank account to your Venmo wallet. Then, you can withdraw money at any ATM with ease of mind.

A piece of advice: In order to increase your Venmo spending limit, you will be required to confirm your identity. And to confirm your identity on Venmo, all you have to do is just share some of your personal details along with your SSN. Doing so, you can become a verified Venmo user and draw the maximum benefits.

How to activate Venmo Debit Card?

The process to activate your Venmo debit card is quite simple and straightforward. All the steps you can follow on your own. These are the steps to follow to activate your Venmo card right through the Venmo app.

- Open the Venmo app on your phone.

- A three horizontal lines icon will come to your view.

- Tap the three lines icon which actually is a menu tab.

- Now scroll down and select the activate Venmo card button.

- Right from here, follow the simple online instructions.

- Further, you might require entering all of your card details such as card number, expiry date, and CVV code.

- Enter carefully all the details. If everything looks fine to you then proceed and complete the process and activate your Venmo Mastercard.

- Once you activate your card, you will all set to ready to spend money seamlessly through the Venmo card.

Also read: How to cancel a Venmo payment?

Final Say

That's the end of today's lesson: How to activate Venmo debit card. In order to make sure you don't make any mistake that other people do, we have also discussed what the fee is for Venmo card use, and limitations. Hopefully, you will find all the information quite helpful and effective. For more information and assistance, feel free to contact us.